This is a sponsored post in collaboration with BusyKid App.

Transform Chores into Financial Education: A Comprehensive Review of the BusyKid App

As summer days stretch long and the kids enjoy their well-deserved break, many parents find themselves navigating the familiar challenge of keeping young ones engaged, responsible, and motivated. For nearly a month now, the rhythm of school has given way to a more relaxed pace, and if it were up to my children, they’d happily spend their days sleeping in. While I’ve never been the most organized when it comes to assigning chores, often relying on spontaneous requests for help, I’ve noticed a significant shift as they get older: getting them to contribute around the house becomes increasingly difficult. The constant nudging and the occasional resistance can turn simple household tasks into a daily battleground.

However, there’s a modern solution designed to turn this challenge into an opportunity for growth and learning. Imagine a world where kids are not just doing chores, but actively managing their earnings, making smart financial decisions, and even learning the basics of investing. This is precisely what the BusyKid App promises to deliver, making chores fun, educational, and genuinely engaging for children of all ages. It’s time to move beyond the traditional allowance system and embrace a tool that equips your children with invaluable financial literacy skills for life.

Revolutionizing Responsibility: How BusyKid App Makes Chores Rewarding

The old saying “money talks” holds true, perhaps even more so when it comes to motivating children. Recognizing this, I’ve decided to implement a structured allowance system to encourage my kids to be more proactive and eager to help around the house. To streamline this process and maximize its educational impact, we’ve embraced the BusyKid App. This innovative platform allows me to effortlessly assign a comprehensive list of chores to my children, track their progress, and even pay them their allowance directly through the app.

What makes BusyKid truly stand out is its emphasis on hands-on learning. Children aren’t just passive recipients of an allowance; they become active participants in managing their own earnings. Whether they’re using a tablet, smartphone, or computer, the app provides a secure and engaging environment for them to interact with their money. This direct engagement fosters a deeper understanding of financial concepts, transforming abstract ideas into tangible experiences. From the moment they complete a chore to the exciting decision of how to use their hard-earned money, BusyKid turns every step into a valuable lesson in financial responsibility.

Effortless Chore Management and Seamless Payments for Modern Families

The BusyKid App is designed with both parents and children in mind, simplifying the entire chore and allowance process. Available conveniently on both iOS and Android devices, it offers a comprehensive family enrollment for a single annual fee of just $14.95. For those eager to test the waters, BusyKid offers an enticing **FREE 30-day trial**, allowing families to experience its transformative benefits firsthand without commitment. This trial period is ample time to see how the app can bring order to your household tasks and ignite your children’s financial understanding.

One of the most praised features of BusyKid is its robust chore assignment system. The app provides age-appropriate chore suggestions for children between 5 and 17, making it easy for parents to tailor tasks to each child’s capability. Beyond suggestions, you have the flexibility to create custom chores, set specific days for completion, and assign the exact allowance amount for each task. This level of customization ensures that the system aligns perfectly with your family’s unique needs and values.

Once chores are completed, children can check them off within the app, signifying their accomplishment. The payment process is equally straightforward: parents can schedule payouts on a specific day of the week, and crucial for peace of mind, **parental approval is required** before any funds are officially released. This ensures that parents maintain oversight and can have conversations with their children about their earnings, further reinforcing financial lessons. The transparent and organized system eliminates guesswork and reduces friction, making chore time a cooperative effort rather than a point of contention.

Beyond the Piggy Bank: BusyKid’s Unique Financial Literacy Features

What truly sets BusyKid apart from other allowance apps is its groundbreaking approach to financial education, offering features that go far beyond simple earning and spending. This app introduces children to the sophisticated concepts of investing and philanthropy, providing a holistic view of money management that is crucial for their future financial success.

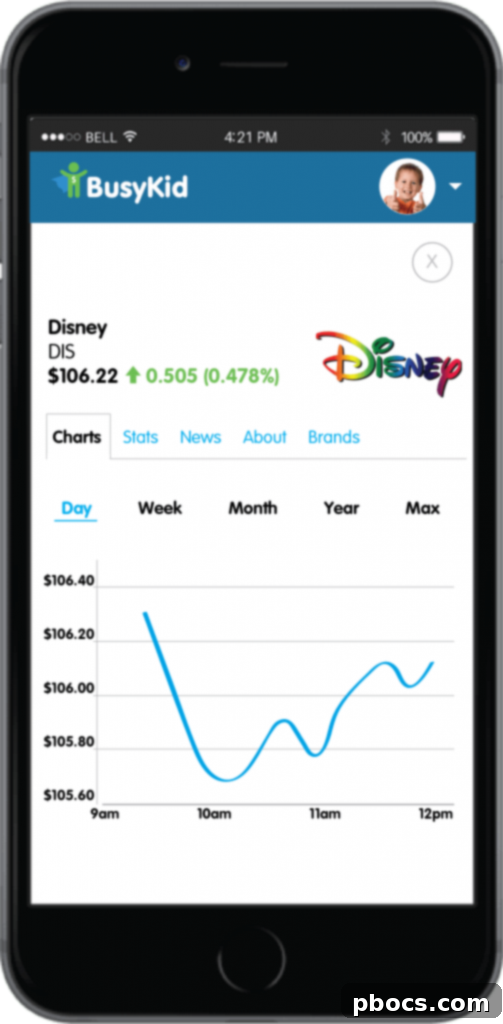

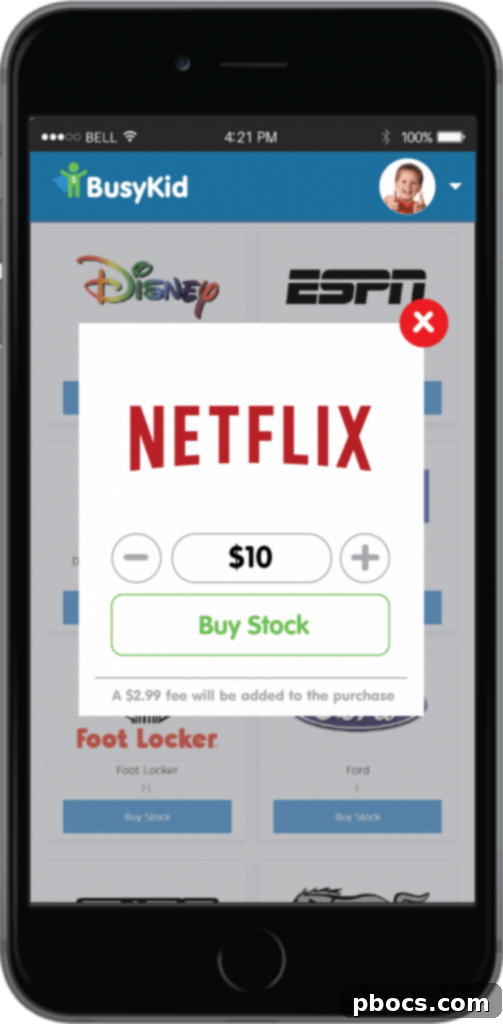

Empowering Future Investors: Fractional Shares and the Stockpile Partnership

My absolute favorite feature, and one that highlights BusyKid’s innovative spirit, is its exclusive partnership with Stockpile. BusyKid is currently the only app of its kind that gives children the extraordinary option to spend their allowance on fractional shares of real stock. This means that instead of just saving money in a traditional account, kids can actually become shareholders in companies they admire, learning about the stock market in a practical, low-risk environment. This early exposure to investing demystifies the world of finance and teaches valuable lessons about growth, risk, and long-term financial planning. Imagine your child owning a piece of their favorite tech company or toy manufacturer – it transforms abstract financial concepts into exciting, tangible realities.

Cultivating Generosity: Charitable Giving Made Easy

Beyond personal gain, BusyKid also fosters a spirit of generosity. Children have the option to make direct donations to a variety of recognized charities directly through the app. This feature is instrumental in teaching the importance of giving back to the community and understanding the impact their money can have on others. It instills empathy and a sense of social responsibility, showing children that money isn’t just for personal consumption but can also be a powerful tool for good. This balance of earning, saving, investing, and giving truly provides a well-rounded financial education.

Practical Spending: BusyKid Points and the Reloadable Debit Card

For everyday use, BusyKid offers flexible spending options. Children can choose to use their BusyKid points for various online or in-store purchases, or they can opt for a reloadable debit card, available for a nominal fee of $5 per year. This debit card functions like a real banking tool, allowing kids to make purchases both online and in brick-and-mortar stores, all while staying within parental oversight. This practical experience is vital for understanding budgeting, tracking expenses, and making informed purchasing decisions. I love that the app empowers them to make independent decisions on how they choose to spend, donate, or invest their earnings, truly giving them control and responsibility over their financial future.

Why Financial Education Matters: The Long-Term Impact of BusyKid

While children are naturally expected to contribute to household chores, it’s time to re-evaluate the traditional allowance system and view it as an integral part of their overall education. In today’s complex financial world, simply handing out cash without context is a missed opportunity. Children need hands-on experiences when it comes to earning, saving, spending, investing, and managing money. If they don’t gain these critical skills from their parents and through practical tools like BusyKid, they are likely to enter adulthood ill-prepared for financial independence.

Parents often grapple with the best ways to teach their children about money. While traditional allowances are a start, BusyKid elevates this concept into a comprehensive financial education platform. It’s not just about earning; it’s about understanding the value of work, the power of saving, the potential of investing, and the joy of giving back. By integrating these lessons into daily life through chores, BusyKid helps bridge the significant gap in financial literacy that often exists in our educational systems. It provides a safe and structured environment for children to experiment with financial decisions, learn from their choices, and build confidence long before they face real-world financial pressures.

Equipping children with strong money management skills from a young age is one of the most powerful gifts a parent can give. It fosters responsibility, teaches the value of hard work, and lays the groundwork for a secure financial future. BusyKid isn’t just an app for chores; it’s an investment in your child’s financial intelligence and independence.

Join Thousands of Families Building Financially Smart Kids

The impressive statistics below speak volumes about the tangible impact BusyKid has had on families, showcasing a vibrant and engaged community where children are actively learning and managing their money:

- Over 200,000 chores successfully completed, demonstrating consistent engagement and productivity.

- More than $91,000 paid out in well-deserved bonuses, recognizing extra effort and achievements.

- Over $101,000 allowances earned by kids through their diligent work, highlighting the real financial rewards of responsibility.

- Over $33,000 loaded onto BusyKid spend cards, facilitating real-world purchases and practical money management experiences.

These figures are not just numbers; they represent countless instances where children have learned the value of a dollar, the discipline of saving, and the excitement of making informed financial choices. BusyKid isn’t just an app; it’s a proven system helping thousands of families cultivate a generation of financially savvy and responsible individuals.

Ready to Transform Chores and Teach Lasting Money Skills?

If you’re seeking a modern, engaging, and highly effective way to teach your children about money, responsibility, and the undeniable value of hard work, the BusyKid App is undoubtedly your ultimate solution. It streamlines chore management, simplifies allowance payments, and most importantly, provides an unparalleled platform for financial education that prepares children for the complexities of the real world. Say goodbye to daily chore-time battles and frustrating discussions about money, and say hello to a household where children are motivated, responsible, and on their way to becoming financially literate. Don’t just manage chores; empower your children with essential life skills. Start your free trial today and witness the remarkable transformation in your family dynamics and your children’s financial acumen!